When anxiety hits, do you know what to do next?

Learn how to calm your body, interrupt fear loops, and regain control step by step.

TL;DR

Dealing with finance & anxiety is a real struggle, but you’re not alone. Here’s a reminder of what truly matters:

What Is Financial Anxiety?

Financial anxiety is a persistent, overwhelming fear or stress related to money and managing finances. It’s an uncontrollable worry about debt, unstable income, unexpected expenses, or long-term financial security.

Unlike ordinary money stress, financial anxiety triggers a physiological response similar to fight-or-flight. It can make even simple tasks, like checking your balance or opening bills, feel like threats.

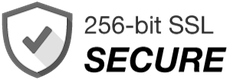

Signs of Financial Anxiety

It’s not just “stress.” Financial anxiety is a chronic, exhausting, and often shame-laced experience that can trigger:

Real-Life Example: Rent, Ramen, and Racing Thoughts

Meet Jordan. He’s 32, and he freelances as a copywriter. Thanks to late client payments, he's living on noodles and hope. His rent is overdue, his internet bill just bounced, and the fridge contains half a lemon and expired hummus. Last night, a friend casually invited him to brunch, and he nearly cried.

His anxiety isn’t irrational. It’s responding accurately to real insecurity. And yet, his mind still whispers:

“You're failing. You're falling behind. You’ll never catch up.”

Laugh, or You’ll Cry (Possibly Both)

You’ve canceled subscriptions you forgot existed. You’ve eaten cereal for dinner three nights in a row. You once transferred $1.32 between accounts like it was a CIA mission.

You're not alone - and you're not a failure. You're human in late-stage capitalism.

A little humor breaks the shame spiral.

It creates room for grace, creativity, and growth.

But if you cry, it’s totally OK - you may not know that there are benefits to crying too!

Why Does Being Broke Trigger Anxiety and Panic Attacks?

Your brain cares about your survival, not the dollar amount in your wallet or bank account. But you see, money isn’t just numbers in an app; it means food, shelter, healthcare, security, freedom.

So, when your finances seem unstable, your nervous system activates the same fight-or-flight response that kept our ancestors alive in danger.

Your amygdala, the fear center of your brain, can’t tell the difference between a lion and a looming bill. At the same time, your prefrontal cortex (responsible for logical reasoning) goes offline.

This makes it impossible just to stay calm and find a solution to the problem. When financial scares trigger repeated panic responses, your brain starts anticipating danger even when none exists. That's how financial anxiety takes root.

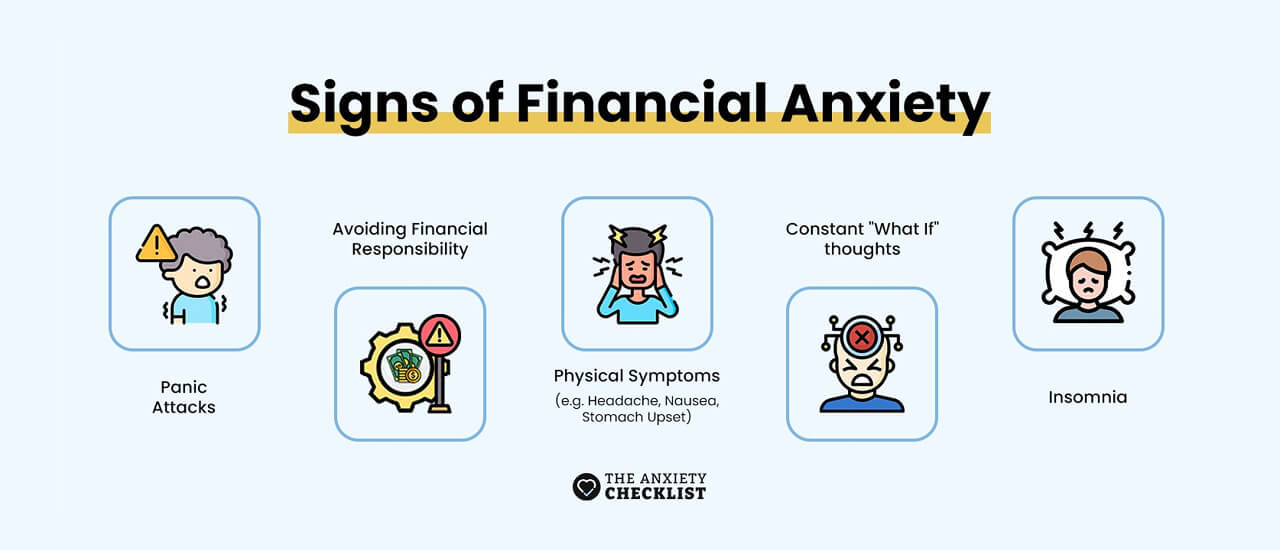

Symptoms of Panic Attacks Due to Financial Matters

Financial panic attacks can trigger physiological symptoms that scare your entire being - body and soul:

What You Should Be Asking Yourself (Instead of Just “How Much Is in My Account?”)

Financial anxiety doesn’t make the numbers look better. It can even paralyze you and stop you from taking positive actions. If you're stuck in financial anxiety, ask these questions instead of doom-scrolling your online banking app:

1. What Am I Really Afraid Of?

Is it just the money? Or is it what the money situation represents? (Shame? Powerlessness? Failure?)

Often, the anxiety isn’t just financial. It’s emotional. And naming it reduces its grip.

2. Am I Jumping to Worst-Case Scenarios?

Panic thrives on catastrophic thinking:

3. What’s Actually in My Control Right Now?

Financial anxiety loves vagueness. So get specific.

- Can I cancel or pause any subscriptions?

- Can I negotiate a bill or rent delay?

- Can I do a freelance gig, sell something, or apply for relief?

- Finding one concrete action short-circuits helplessness.

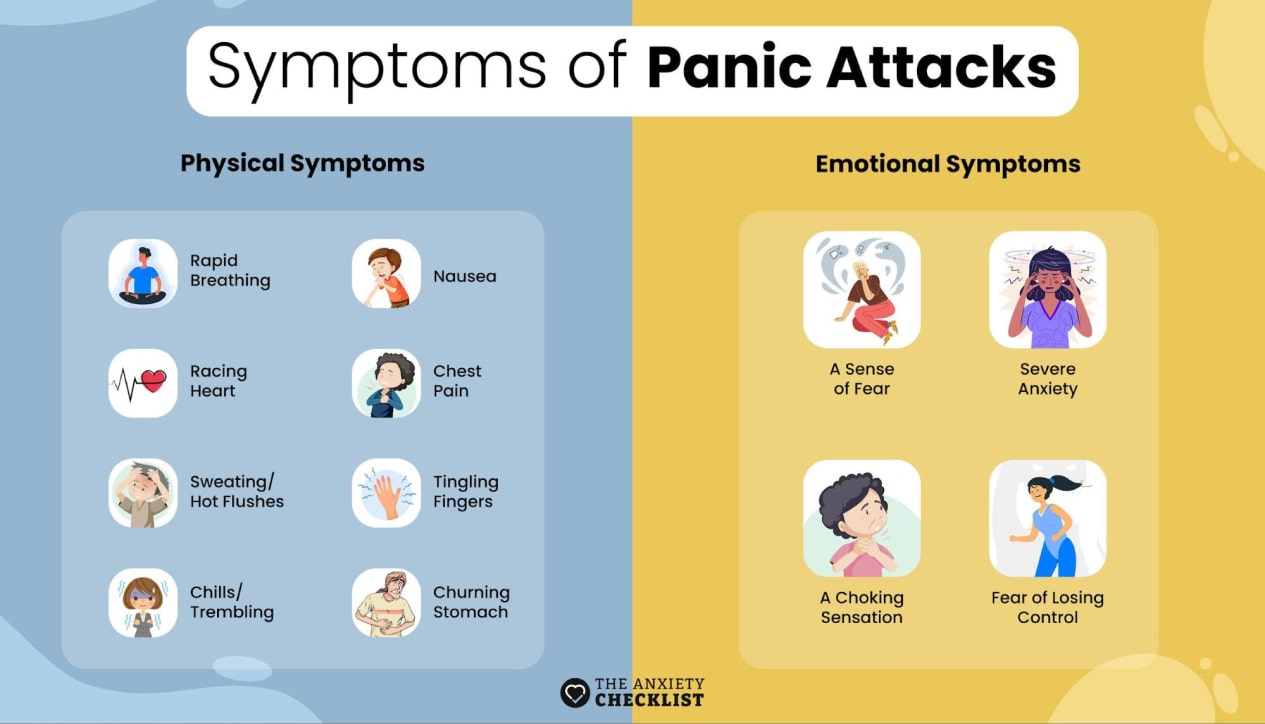

How to Manage Financial Anxiety

Financial anxiety doesn’t mean you’re bad with money. You don’t need a financial guru. You need strategies that blend psychology with practicality. Whether your anxiety over finances comes from uncertainty, past mistakes, or debt, small shifts in mindset and habits can make a big difference.

Step 1: Ground Yourself First

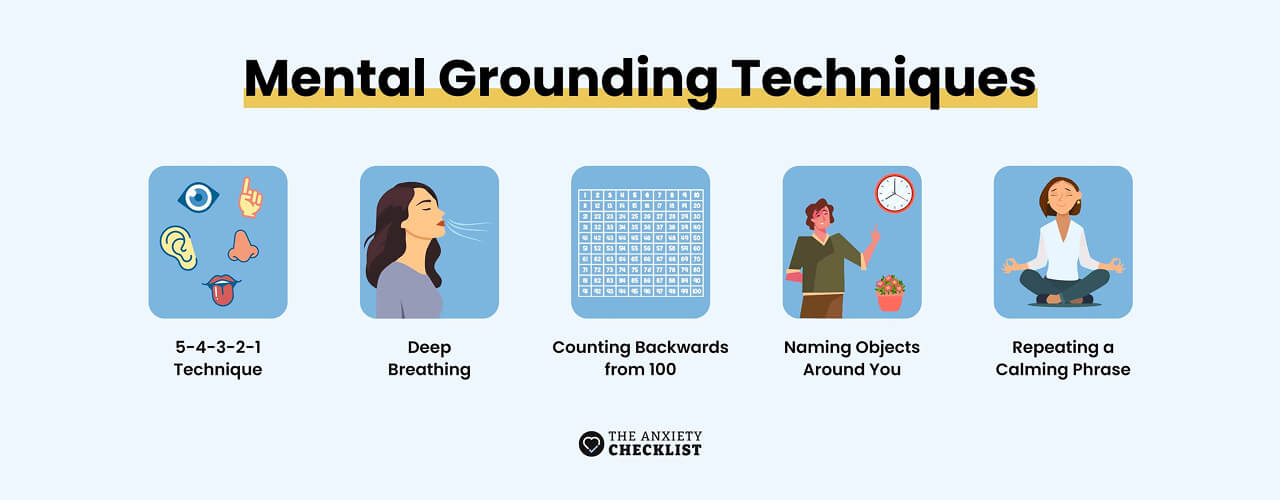

You can’t solve money problems while in panic mode. Your brain can’t prioritize logic over fear. Before opening spreadsheets or money apps, pause. Try the 5-4-3-2-1 grounding technique:

Step 2: Open the Damn Bank App

It’s scary. However, avoiding it doesn’t make the problem disappear — it simply allows it to grow. Financial anxiety invites cognitive distortions, spinning scary ideas that don’t match reality.

So, here’s what you’ll do:

Set a 15-minute timer. Light a candle. Pour some tea. And face the financial monster.

Checking your balance is like looking in the fridge: it may be depressing, but now you know.

Knowing your exact income, expenses, and remaining funds allows you to take charge of your financial decisions, rather than letting fear dictate your actions.

Step 3: Make a “Bare Bones” Budget

Ask, “What do I absolutely need to survive this month?”

Think about the essentials that keep you safe and fed — your rent, groceries, and a way to get around.

Managing financial anxiety isn't about cutting out every little joy. It's about identifying your core needs and letting go of anything extra for now, like that third streaming service you forgot you even had.

Even a scrappy, imperfect budget makes anxiety less overwhelming.

Now that you’ve a plan.

Step 4: Give Yourself an Emergency Playbook

Financial anxiety says, “You have no options.”

Reality says, “You just haven’t listed them yet.”

Financial anxiety thrives on that trapped feeling, as if you’re backed into a corner with no way out. But you can escape that crisis mode by creating a fallback list:

Step 5: Rewrite Your Money Mindset

Your relationship with money is shaped by invisible scripts running in your subconscious mind. They make you believe that:

Frequently Asked Questions

The symptoms of financial anxiety can be physical, mental, or behavioral:

Here’s how to stop financial anxiety:

Final Thoughts

Previous Article

How Oprah's Book "What Happened to You" Explains Trauma

If you are in a crisis or any other person may be in danger - don't use this site. These resources can provide you with immediate help.